In today’s fast-paced business landscape, adopting effective Business Process Management Software (BPMS) has become essential for companies looking to streamline operations and drive growth. This powerful BPM platform can optimize workflows, enhance team collaboration, and deliver significant cost savings. However, with a variety of BPM features available, businesses may find the BPM selection process daunting. Understanding the specific needs of your organization is critical in identifying the best integrated BPM solutions that suit your goals. By leveraging these tools wisely, businesses can achieve unparalleled efficiency and agility, positioning themselves for long-term success.

Another term often associated with the realm of operational excellence is workflow automation software, which encompasses tools designed to boost efficiency by automating repetitive tasks. Organizations are increasingly turning toward process optimization technologies to enhance transparency and speed up decision-making processes. When selecting such solutions, it is vital to consider their ability to integrate seamlessly with existing systems, ensuring data flows smoothly across various departments. The quest for the optimal operational framework often leads to discussions surrounding scalable business solutions that cater to evolving market needs. Ultimately, the right choice in these software applications can lay the groundwork for transformative business enhancement.

Understanding the Importance of Business Process Management Software

In today’s rapidly evolving business landscape, the importance of Business Process Management (BPM) software cannot be overstated. It serves as a pivotal tool for organizations seeking to enhance their operational efficiency and agility. A well-chosen BPM platform enables businesses to streamline processes, reduce bottlenecks, and improve overall workflow visibility. Therefore, investing in an effective BPM solution is not merely a technological choice; it is an essential strategy for achieving long-term success and sustainability.

Furthermore, implementing a BPM platform can significantly impact key performance outcomes such as cost savings, process transparency, and faster turnaround times. Effective business process optimization through BPM provides organizations a competitive edge, fostering an environment of continuous improvement. Thus, understanding how various BPM features can align with your specific business needs is crucial for making an informed selection.

Key Factors to Consider During BPM Selection

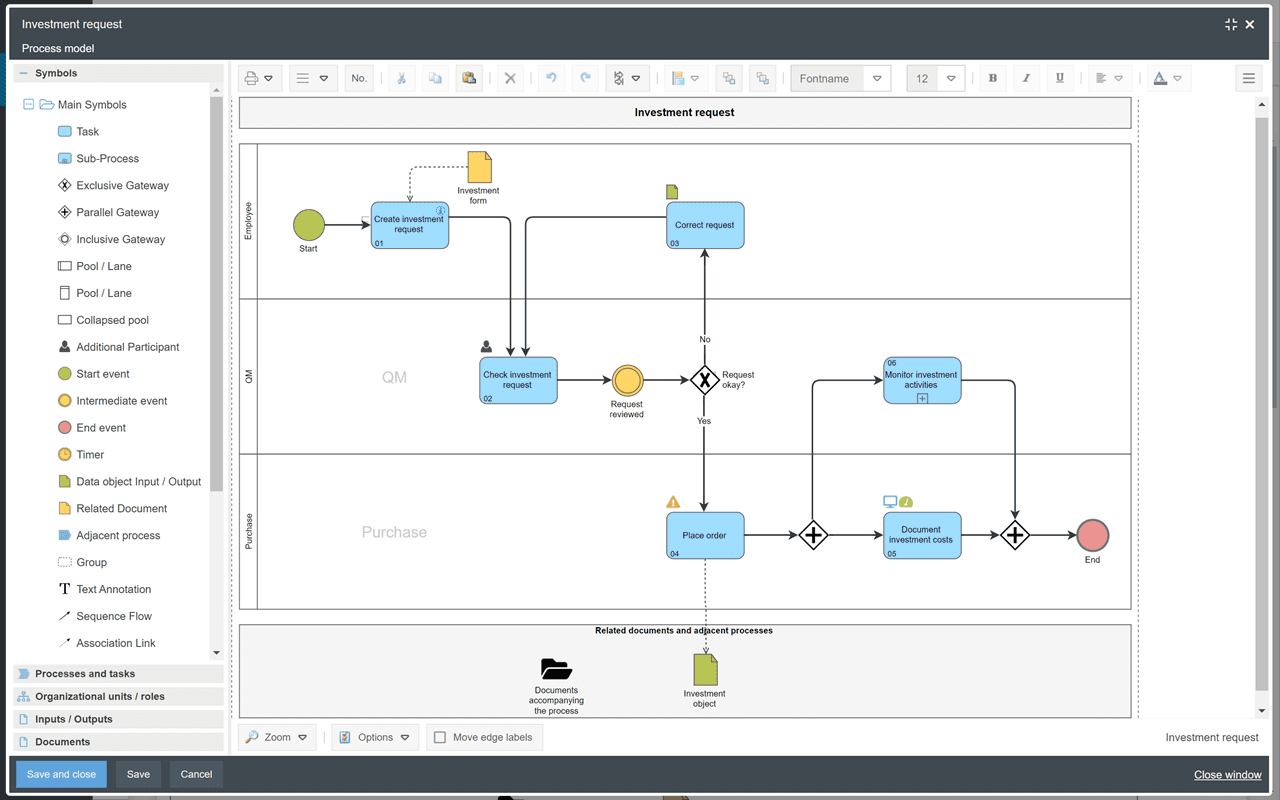

When it comes to BPM selection, evaluating your business needs is paramount. Begin by identifying the challenges that impede productivity, such as manual processes or slow approvals. By mapping out which processes require enhancement, you will be better positioned to select a BPM software that directly addresses those specific pain points. This thoughtful approach to BPM selection aids in aligning the chosen software with your organization’s strategic goals, thus facilitating efficient business process optimization.

Moreover, it is crucial to assess integration capabilities alongside features when selecting a BPM solution. A robust BPM platform should seamlessly integrate with existing systems—like CRM and ERP—allowing data flow across various functional areas. Effective integration not only minimizes the risk of data entry errors but also enhances real-time decision-making capabilities, which is vital in maintaining operational efficiency.

Scalability and Flexibility in BPM Solutions

Scalability and flexibility are vital attributes of any BPM solution. As organizations grow and evolve, their process management needs may also change. An agile BPM platform can accommodate increased workloads while ensuring that performance remains uncompromised. Look for BPM solutions that offer customization options that can be tailored to your evolving business model. This adaptability will ensure your BPM solution remains relevant and continues to deliver value over time.

Moreover, the ability to quickly adjust to market demands or internal changes through flexible BPM features can be a game-changer for organizations. Businesses should consider how easily they can modify workflows or processes without extensive downtime or technical difficulties. This adaptability not only enhances efficiency but also fosters an environment conducive to innovation and growth.

The Significance of User Experience in BPM Adoption

User experience plays a critical role in the successful adoption of BPM solutions. A user-friendly interface greatly eases the transition for employees, facilitating quicker onboarding and higher satisfaction levels. As organizations implement new systems, the ease of use directly impacts the rate at which staff adapts to the new tools. A streamlined workflow simulation and intuitive navigation are often key factors in achieving widespread acceptance within the organization.

Additionally, a positive user experience correlates with improved productivity. When employees find BPM software easy to use, they are more likely to fully engage with its features, leveraging the tool’s capabilities to optimize their workflows. Therefore, focusing on user-centric design in your BPM selection process can lead to enhanced collaboration and efficiency across all levels of the organization.

Ensuring Security and Compliance with BPM Software

In the era of heightened data privacy concerns, ensuring security and compliance is paramount when selecting BPM software. Businesses must verify that their chosen BPM solutions adhere to the latest industry standards for data protection and regulatory compliance. Features like role-based access control and data encryption are essential in safeguarding sensitive information and maintaining stakeholder trust.

Moreover, incorporating BPM solutions that routinely offer updates towards compliance with regulatory changes will ensure your organization remains mindful of its ethical and legal obligations. This proactive approach to security not only protects your company’s data but also enhances your reputation in the marketplace, a crucial factor in today’s digital age.

Vendor Support and Community Engagement in BPM Implementation

A strong network of vendor support can significantly enhance the value of your BPM implementation. It’s essential to choose a BPM solution that offers reliable vendor backing, including access to experienced developers and comprehensive training resources. This support will ensure that any issues encountered during the deployment of BPM solutions are adequately addressed, leading to smoother transitions and less downtime.

Moreover, being part of a community of users can provide invaluable insights into best practices and evolving features. Active communities offer a platform for sharing experiences, which can help organizations maximize the use of their BPM software. Engaging with such networks can lead to enhanced learning opportunities, ensuring that users continually achieve the most efficient use of their chosen BPM solutions.

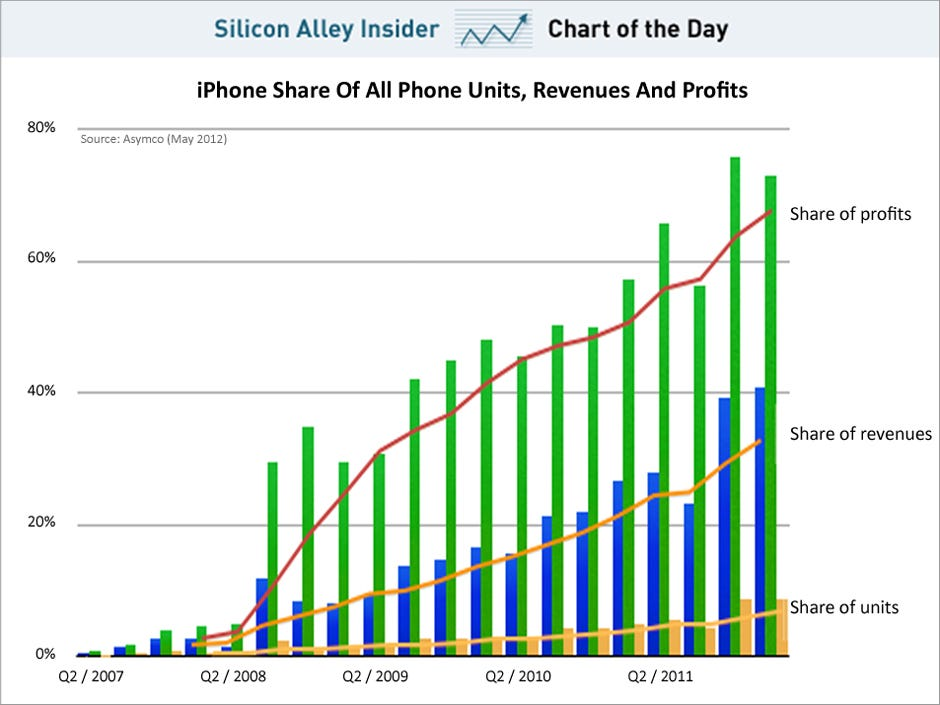

Calculating the Cost and Return on Investment for BPM Solutions

Cost considerations are critical when selecting BPM software. However, businesses should not only focus on the initial investment but also on the long-term return on investment (ROI) that effective BPM solutions can yield. Evaluating potential cost savings, productivity boosts, and efficiency gains associated with the new software is essential for assessing its overall value to your organization.

Thus, it’s vital to perform a comprehensive analysis of expected efficiencies and savings against the upfront and ongoing costs of the BPM software. This thorough evaluation will empower organizations to make informed decisions, ensuring they select solutions that deliver significant value and contribute positively to their bottom line.

Embracing Innovative Features in Modern BPM Solutions

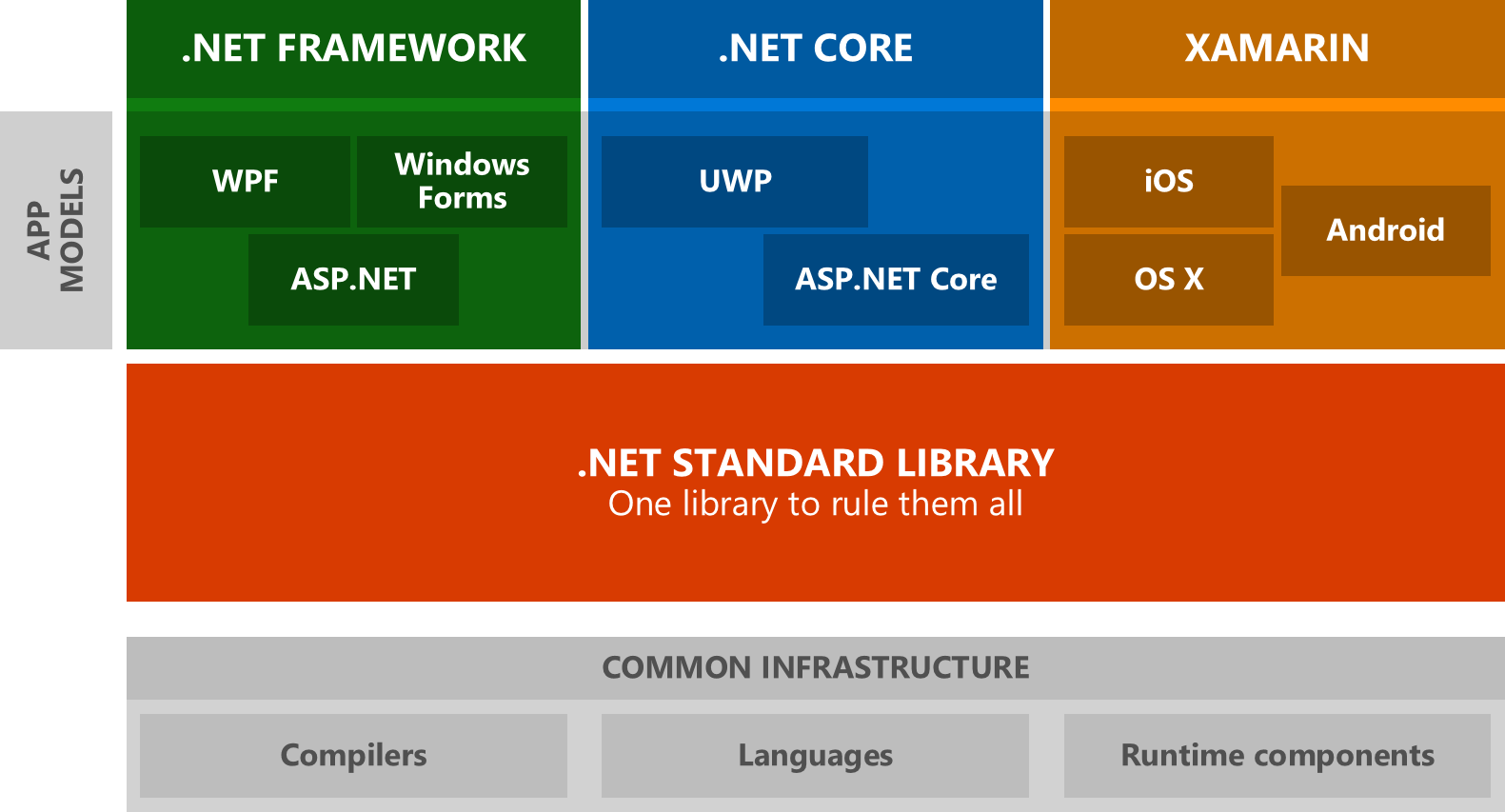

Incorporating innovative features is essential for organizations seeking to remain competitive in today’s marketplace. Modern BPM solutions often include advanced capabilities, such as Robotic Process Automation (RPA) and Artificial Intelligence (AI), which serve to enhance process efficiencies and accelerate decision-making. Embracing these technologies can vastly change how organizations operate, allowing them to respond to market dynamics with agility.

Furthermore, the introduction of low-code/no-code platforms within BPM solutions enables businesses to develop applications rapidly without extensive coding knowledge. This democratization of development can empower non-technical staff to contribute to process improvements, driving innovation directly from within the organization. By harnessing these innovative features, organizations can align their BPM strategies with digital transformation goals.

Choosing the Right Business Process Management Software for Future Growth

Selecting the appropriate business process management software is a multifaceted endeavor that requires careful consideration of various elements encompassing your organization’s needs. From assessing functional requirements and integration capabilities to evaluating scalability, user experience, and security, each aspect carries significant weight in your overall decision-making process. By taking a comprehensive approach, organizations can ensure that they choose a BPM solution that will facilitate long-term growth and adaptability.

Moreover, reflecting on innovative features and support provisions offered by BPM software vendors can further enhance the selection process. By prioritizing solutions that provide robust support and innovative functionality, companies can better position themselves for future challenges and opportunities. Ultimately, a well-informed BPM selection process lays the groundwork for sustainable process improvement and organizational excellence.

Frequently Asked Questions

What is Business Process Management Software and why is it important?

Business Process Management Software (BPM software) is a technology that enables organizations to model, analyze, and optimize their business processes. Choosing the right BPM platform is crucial for improving efficiency, agility, and operational capabilities, especially in today’s dynamic business environment.

How can I assess my business needs for BPM selection?

To assess your business needs for BPM selection, begin by identifying current challenges such as slow approval processes or repetitive manual tasks. Mapping out these processes will help pinpoint which BPM features are necessary to improve your organization’s productivity and collaboration.

What key factors should I consider in a BPM platform evaluation?

When evaluating a BPM platform, consider integration capabilities, user experience, scalability, security and compliance measures, vendor support, and cost. Ensuring that the BPM solution aligns with your business goals is essential for effective process management.

Why are integration capabilities important in Business Process Management Software?

Integration capabilities in Business Process Management Software are important because they allow for seamless communication between different systems, such as CRM, ERP, and HR software. This integration reduces manual data entry, enhances efficiency, and promotes real-time access to critical business information.

How does user experience affect the adoption of Business Process Management Software?

User experience significantly affects the adoption of Business Process Management Software. A user-friendly interface facilitates easier onboarding and encourages staff to embrace new workflows, ensuring a smoother transition and maximizing the benefits of the BPM platform.

What role does security play in selecting BPM software?

Security plays a critical role in selecting BPM software. It is vital to confirm that the software complies with industry data security standards and incorporates features such as role-based access control and data encryption to safeguard sensitive information.

What innovative features should I look for in modern BPM solutions?

When selecting BPM solutions, look for innovative features such as Robotic Process Automation (RPA), Artificial Intelligence (AI), and low-code/no-code development options. These features can enhance process automation and support better, faster decision-making.

How can I evaluate the cost and ROI of Business Process Management Software?

To evaluate the cost and ROI of BPM software, consider not only the initial expenses but also the potential efficiencies, cost savings, and productivity gains it may bring. Calculating the expected return on investment will help you make a more informed decision.

What support should I expect from my BPM software vendor?

You should expect your BPM software vendor to provide robust support, including access to experienced developers, comprehensive training materials, and a community of users for sharing insights and troubleshooting, all of which enhance the functionality and value of the BPM platform.

How can Business Process Management Software help with business process optimization?

Business Process Management Software aids in business process optimization by allowing organizations to analyze their current workflows, identify inefficiencies, and implement improvements. With the right BPM platform, you can streamline operations, boost productivity, and enhance collaboration across departments.

| Key Point | Details |

|---|---|

| Assess Your Business Needs | Identify operational weaknesses and map out processes to improve. |

| Evaluate Integration Capabilities | Ensure the BPM software integrates well with existing systems. |

| Consider Scalability and Flexibility | The BPM should grow with your business and adapt to changing needs. |

| User Experience is Key | A user-friendly interface promotes easy adoption and smooth workflows. |

| Security and Compliance | Ensure compliance with data security and regulatory standards. |

| Vendor Support and Community of Users | Access to strong vendor support enhances usage and results. |

| Evaluate Cost and ROI | Consider overall value and calculate the return on investment. |

| Adopt Innovative Features | Look for modern features like AI and RPA for process automation. |

Summary

Business Process Management Software plays a pivotal role in optimizing an organization’s operations. Selecting the right BPM solution is essential for enhancing efficiency, agility, and capability in today’s competitive landscape. By assessing your business needs, evaluating integration and scalability, and ensuring user-friendly experience along with strong vendor support, organizations can seamlessly implement effective BPM solutions. Additionally, considering security, compliance, cost-effectiveness, and innovative features will further empower organizations to foster growth and innovation. Ultimately, a well-chosen BPM software not only improves your business processes but also paves the way for sustained success.