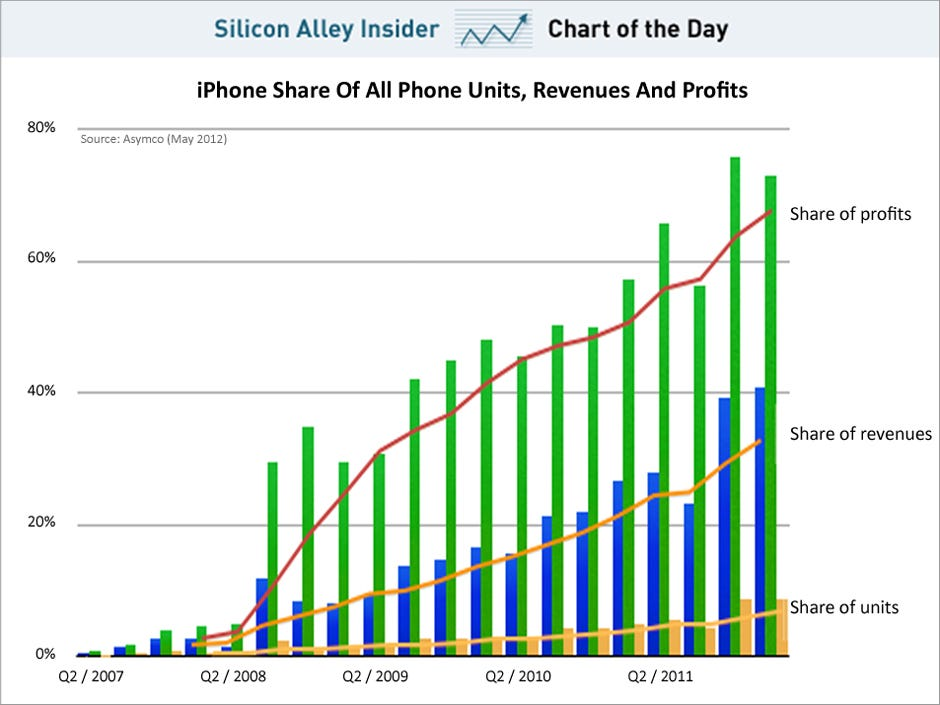

In the competitive landscape of the smartphone industry, Apple smartphone profits stand out remarkably, as the tech giant captured a staggering 94% of the total profits in Q3 2015. Even with just a 13.4% smartphone market share, Apple’s ability to sell its premium-priced iPhones showcases the brand loyalty it has cultivated since its entry into the market in 2007. With iPhone sales in 2015 drastically outpacing those of its competitors, it’s clear that Apple has mastered the art of appealing to customers willing to invest in high-value products. While brands like Xiaomi and Huawei have gained traction with budget-friendly offerings, they are yet to achieve similar profit margins, indicating a significant disparity in market strategies. As Canaccord Genuity’s data highlights, despite the influx of affordable smartphones, Apple remains the dominant player in terms of profitability in the ever-evolving smartphone landscape.

When exploring the financial prowess of Apple in the smartphone sector, it’s evident that Apple smartphone margins are unparalleled, even amidst increasing competition. The Cupertino-based company has not only maintained its solid foothold since the launch of its first iPhone but also strategically positioned itself as a luxury tech brand in a crowded marketplace. During 2015, various smartphone manufacturers, including those from China, attempted to disrupt this dominance, yet they fell short in terms of profit generation. The rise of alternatives like Xiaomi and Huawei has shifted some focus towards lower-cost devices, but they still struggle with profit compared to Apple’s established high-end devices. Overall, Apple’s ability to secure an overwhelming share of profits, despite relatively modest market penetration, underscores its unique value proposition in the world of mobile devices.

Apple’s Smartphone Profits and Market Dominance

In Q3 2015, Apple achieved remarkable success by capturing a staggering 94% of the total profits from the global smartphone market, despite holding only a 13.4% market share in terms of unit shipments. This significant disparity highlights the premium pricing strategy employed by Apple for its iPhones, which allows the company to maximize its profit margins even with a smaller fraction of the overall sales volume. Brand loyalty plays an essential role here, as Apple’s dedicated customer base is often willing to pay a premium for the latest iPhone, reinforcing the brand’s perceived value in the competitive landscape of smartphone sales.

Furthermore, this unprecedented profit achievement underscores the effectiveness of Apple’s marketing and product positioning. While competitors like Samsung were losing ground, capturing only 11% of the profit share in the same quarter, Apple remained steadfast in its premium approach to smartphone design and functionality. The profits sourced from iPhone sales in 2015 set the company apart from others in the industry, revealing how Apple’s strategy has positioned it as a leader in profitability amidst a crowded marketplace.

Impact of Xiaomi and Huawei on the Smartphone Market

While Apple dominated the profits in Q3 2015, the aggressive pricing strategies of competitors like Xiaomi and Huawei have significantly disrupted the smartphone market landscape. These companies have flooded the market with low-cost devices, targeting budget-conscious consumers who might otherwise gravitate towards premium brands. However, despite their substantial market penetration and growing smartphone market share, both Xiaomi and Huawei struggle to secure comparable profit margins due to their lower price points and reliance on sheer volume, leaving a majority of the profits to be claimed by likelier competitors.

Moreover, the entrance of these Chinese manufacturers has heightened the competition within the smartphone industry, pushing established players like Apple and Samsung to innovate constantly and refine their marketing tactics. Xiaomi’s market impact has been particularly noteworthy, as they have demonstrated how effective pricing and a robust feature set can challenge traditional norms of lavish pricing models, ultimately altering the purchasing behaviors of consumers. This shift necessitates that brands like Apple re-evaluate their strategies to maintain their competitive edge in an increasingly saturated market.

The Battle Between iPhone and Android Devices

The ongoing rivalry between Apple’s iPhone and devices powered by Google’s Android operating system remains a focal point in the smartphone landscape. As of Q3 2015, the competition was intensifying, with Apple firmly rooting for its premium hardware coupled with robust application ecosystems against the ensemble of diverse Android manufacturers including Samsung, Huawei, and Xiaomi. This segmentation within the Android market creates a unique challenge for Apple, pushing the company to continuously innovate in order to retain its customer base and entice new consumers.

Amid this rivalry, the landscape shows that while Android devices are abundant and offer a range of prices and features, Apple’s focus on user experience, software updates, and integration across devices positions it uniquely in the market. Notably, this battle is not simply about specs; it revolves around brand loyalty and the perceived quality that comes with each device. As Neil Mawston, executive director at Strategy Analytics noted, the risk lies in being trapped between premium devices and an affordable Android array, necessitating that Apple continually sharpen its value proposition to stay ahead.

Canaccord Genuity’s Analysis of Smartphone Profits

The analysis provided by Canaccord Genuity sheds light on the financial dynamics of the smartphone market, particularly regarding profit distribution. Their report highlighted how Apple’s stronghold on profits underscores the power dynamics at play, as the company manages to secure the lion’s share despite not dominating in terms of market share. This disparity suggests a complex interplay of consumer behavior and brand reliability, where consumers prioritize the ecosystem and perceived value offered by Apple over alternatives.

However, Canaccord Genuity also acknowledges potential inaccuracies within its findings due to the rapid growth of low-cost smartphone manufacturers like Huawei. Their commentary reflects the challenges of measuring profitability amidst a diverse competitive landscape, where new entrants continue to challenge traditional success models. This ongoing economic analysis is crucial as it informs industry players about shifting trends and consumer preferences, ultimately guiding future strategies and product developments.

The Challenge of Competing with Chinese OEMs

As Apple continues to thrive, the growing influence of Chinese OEMs such as Huawei and Xiaomi presents an increasing challenge. These companies have made significant inroads into various markets, offering high-quality devices at substantially lower prices. Their aggressive marketing tactics and rapid innovation cycles have allowed them to appeal to price-sensitive consumers looking for quality alternatives to premium brands like Apple.

Despite Apple’s brand allure and loyal customer base, the influx of affordable options threatens to erode its market share over time. The competition forces Apple to balance its premium pricing strategy with the need to offer value, emphasizing quality features and exceptional user experiences that justify the costs. Navigating this competitive landscape will require Apple to adopt adaptive strategies, ensuring they can withstand pressures from brands that prioritize volume over margins.

Apple’s Strategic Advantages in the Smartphone Market

Apple’s long-established reputation and innovative prowess offer significant advantages in the smartphone market. The company’s commitment to developing a seamless ecosystem among its devices has established a strong sense of brand loyalty amongst its consumers. Features like iCloud, Apple Music, and seamless integration across devices create a holistic experience that differentiates Apple from competitors. This ecosystem approach not only retains customers but also attracts new users looking for a cohesive experience across their digital devices.

Additionally, Apple’s strategic focus on quality and design plays a pivotal role in establishing its premium marketing position. By prioritizing user experience and aesthetic appeal, Apple is often perceived as a leader in both technology and trend-setting. This reputation enables it to maintain higher profit margins compared to competitors who may offer similar hardware specifications but lack the same level of brand prestige or reliability. As competition intensifies, Apple’s ability to innovate and uphold its brand values is critical for sustaining its market position.

The Role of Innovation in Apple’s Market Strategy

Innovation remains a cornerstone of Apple’s strategy in the highly competitive smartphone industry. The company has consistently introduced cutting-edge features that not only enhance user experience but redefine consumer expectations for mobile technology. From the introduction of the first iPhone to the recent focus on augmented reality and AI functionalities, Apple continually sets the bar high. This commitment to innovation not only maintains existing customer loyalty but also attracts new buyers who are eager to experience the latest advancements.

Moreover, the emphasis on innovation also extends beyond hardware into services, as Apple diversifies its revenue streams through services like Apple Pay, app subscriptions, and cloud services. This move not only enhances overall profitability but also fosters deeper engagement with users, making it more challenging for competitors to lure customers away. By continuously evolving its product offerings and services, Apple effectively cements its position as a leader in the smartphone market.

Understanding Consumer Behavior Towards Premium Smartphones

Consumer behavior plays a pivotal role in driving smartphone sales, especially in the context of luxury devices like those offered by Apple. The trend is clear: consumers are increasingly drawn to premium brands that promise superior quality, enhanced features, and status symbolism. Loyal Apple users often view their devices as extensions of their identity, willing to invest in the latest iPhone models, which are viewed not just as functional devices but as lifestyle choices that represent innovation and sophistication.

This inclination towards brand loyalty is influenced by various factors, including social proofs like endorsements from public figures and the integration of technology into everyday life. Apple’s marketing campaigns often exploit these psychological aspects, showcasing the lifestyle benefits of owning an iPhone. Consequently, understanding these consumer dynamics becomes crucial for any brand aiming to compete in the premium smartphone sector. As market conditions evolve, the ability to connect emotionally with consumers is as essential as the products themselves.

Emerging Trends in the Global Smartphone Market

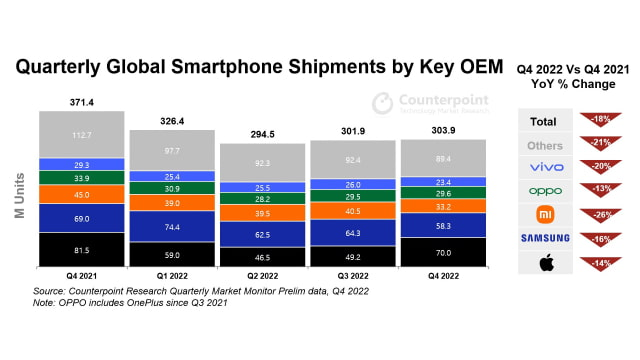

The global smartphone market is witnessing rapid transformations influenced by technological advancements, shifting consumer preferences, and increased competition from emerging brands. Notably, manufacturers like Xiaomi and Huawei have brought forth innovations at affordable prices, significantly impacting overall market dynamics. As these companies continue to gain traction, they create new benchmarks for quality and feature sets, compelling established brands like Apple to reassess their offerings and pricing strategies.

In parallel, trends towards sustainability and ethical consumerism are beginning to shape buying decisions. Consumers are increasingly mindful of the environmental impacts of their purchases, leading many to favor brands that demonstrate commitment to sustainable practices. This shift poses both challenges and opportunities for traditional players in the space, pushing them towards greener innovations. As these trends evolve, the agility to respond and adapt will play a critical role in defining the future landscape of the smartphone market.

Frequently Asked Questions

How did Apple smartphone profits compare in Q3 2015?

In Q3 2015, Apple smartphone profits accounted for a staggering 94% of the total smartphone industry profits despite holding only 13.5% of the global smartphone market share. This striking disparity highlights Apple’s ability to generate significant revenue from its premium-priced iPhones.

What impact did Xiaomi and Huawei have on Apple smartphone profits in 2015?

Xiaomi and Huawei, while increasing their smartphone market share with low-cost devices, did not significantly affect Apple smartphone profits as their profit margins are relatively low. Apple’s strategy focused on high profit levels per device sold, allowing it to dominate profits in Q3 2015 despite limited market share.

What were the iPhone sales in 2015 and their effect on Apple smartphone profits?

iPhone sales in 2015 were robust, contributing to Apple’s remarkable profits. With a strong brand following, Apple sold a significant number of premium devices, allowing the company to capture 94% of the profits in the smartphone market, even as competitors like Samsung and others struggled.

How does Apple maintain its profitability despite a small smartphone market share?

Apple’s profitability, despite only a 13.4% market share in smartphones as of Q3 2015, can be attributed to its premium pricing strategy and a loyal customer base willing to pay a premium for iPhones, leading to significantly higher profit margins than those of competitors.

What challenges does Apple face regarding smartphone competition from companies like Xiaomi and Huawei?

Apple faces growing competition from Xiaomi and Huawei, which focus on high volume, low-cost smartphones, potentially eroding Apple’s market share. However, Apple’s strong brand loyalty and high profit margins per device sold give it an edge in overall profitability against these competitors.

Why is the analysis of Apple smartphone profits in 2015 noted to be possibly inaccurate?

The analysis of Apple smartphone profits in 2015 is considered possibly inaccurate due to rapid market changes, including the surge of low-cost smartphones from companies like Xiaomi and Huawei. These brands are gaining market share while traditionally high-profit segments are being pressured, complicating profit assessments.

What role do services and accessories play in Apple smartphone profits?

Services and accessories play a crucial role in enhancing Apple smartphone profits. Post-purchase revenues from the App Store, subscriptions, and accessories bolster Apple’s revenue, complementing the profits generated from iPhone sales, making it less vulnerable to market share fluctuations.

| Key Point | Data |

|---|---|

| Apple’s Market Share | 13.4% of total smartphones shipped in Q3 2015 |

| Apple’s Profit Share | 94% of total smartphone profits in Q3 2015 |

| Competitors’ Impact | Xiaomi and Huawei have low profit margins and weren’t included in the analysis |

| Samsung’s Market Performance | Held only 11% of total profits in Q3 2015 |

Summary

Apple smartphone profits remained remarkably dominant in Q3 2015, where the company captured 94% of the smartphone market’s total profits despite holding just a 13.4% market share in unit shipments. This substantial disparity showcases Apple’s ability to monetize its product effectively, positioning itself favorably against competitors like Samsung, which struggled to achieve profitability in the same period. Additionally, the rise of low-cost brands such as Xiaomi and Huawei highlights the importance of understanding different strategies in the smartphone market, with these companies focusing on volume rather than profit margins.